Due to H&, R Block’s deceptive “free” online filing advertising and pressure to overpay for its services, the U. S. Federal Trade Commission (FTC ) filed a lawsuit against the tax preparation giant.

In over 12, 000 offices around the world, H&, R Block employs 70, 000 tax professionals. In 2023, the company reported revenue of$ 3.5 billion.

The FTC stated on Friday that despite the fact that many consumers do not require the additional tax forms and schedules offered by those products, H&, R Block’s online tax filing products “lead consumers into higher-cost products made for more complicated Tax filings.”

H&, R Block also fails to make it clear which of its products cover which forms, schedules, or tax situations, which causes many customers to begin filling out tax returns on overpriced goods.

A closer look reveals several problems that have drawn attention, despite the company’s online tax product being advertised as free. The FTC claims that the” simple return” that H&, R Block defines as the only type qualified for the free service is vague and subject to change at the company’s discretion.

Additionally, users are encouraged to buy one of H&, R Block’s paid tax filing products when they realize they do n’t meet the requirements for the free version after entering all of their tax information.  , However, it can be difficult to switch between various versions.

The FTC claims that switching to a more expensive product is fairly simple and that all entered data is automatically transferred.

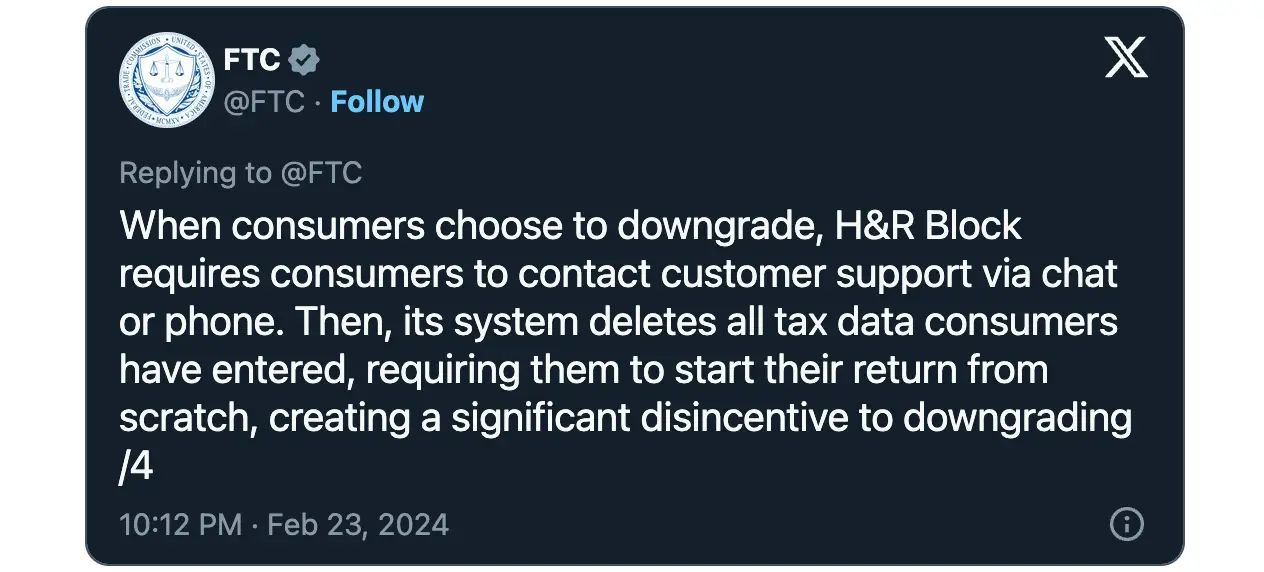

However, attempting to downgrade to a less expensive version by navigating between various versions and  proves difficult and results in the loss of all data entered during the previous steps.

According to the FTC, downgrading customers have had to contact the company to request a downgrade since at least 2014, which has frequently been an inconvenience and time-consuming process.

The FTC also claims that many customers end up buying the company’s more expensive products to avoid having to re-enter their tax information or because it is difficult to get in touch with customer support. Some frustrated customers even decide to stop paying their taxes after investing money and wasting a lot of time in the process.

The FTC today targets H&, R Block’s advertising practices, labeling them as deceptive in addition to worries about product downgrades.

According to the complaint, H&, R Block has long advertised its online tax preparation services as “free,” but many customers are n’t eligible for the free option, so this offer is allegedly deceptive. Additionally, it highlights a number of H& and R Block TV and online advertisements promoting free filing services, frequently containing disclaimers stating that the offer only applies to” simple returns.”

The complaint notes that H&, R Block has repeatedly changed its definition of a” simple return” in recent years, which has confused and irritated consumers. However, the company’s advertisements do not define what constitutes” a simple return.”

For more than 20 years, H&, R Block has offered a free do-it-yourself ( DIY ) filing option to help Americans with their tax filings, according to Dara Redler, the chief legal officer at the tax preparation company.

According to Redler,” The Tax Institute, educational resources, free tools, and calculators are just a few of the many resources we provide to all filers to show how committed we are to making tax filing easier and more transparent for everyone.”

Additionally, H&, R Block enables customers to downgrade to a DIY product that is less expensive while ensuring accurate tax returns are prepared.

Last month, the consumer protection agency also ordered TurboTax maker Intuit  to stop promoting its goods and services as “free” unless all customers must pay for them.